Top 3 Hispanic Shopper Trends Shaping 2026: What CPG leaders need to know now to win retail growth on and off the shelf

If you lead a CPG brand or retail portfolio, Hispanic shoppers are no longer a “segment” in your plan. They are one of the main engines of retail growth. Recent data shows Hispanic shoppers represent about 2.7 trillion dollars in spending power and contribute 23% of U.S. dollar growth, with an outsized impact on grocery, mass and club channels. Circana estimates they drive 16% of total U.S. CPG growth, outpacing non Hispanics in both dollars and units.

Here are three Hispanic shopper trends that should shape your 2026 strategy.

1. Value pressure, but a “more gifts” mindset

CivicScience research finds 43% of Hispanic holiday shoppers plan to spend more than last year, versus 25% who expect to spend less. This is not only about inflation, it is also about buying more gifts. At the same time, Hispanic shoppers are more likely to use Buy Now, Pay Later, expedited shipping and curbside pickup to stretch budgets.

For CPG leaders, that calls for smart value, not just deeper discounts. Think stock-up bundles, family-sized packs and promotions that highlight quality, nutrition and family benefit. Pair price with a clear story about how your product helps them do more for their household, not just pay less.

2. Mobile-first discovery, omnichannel journeys, store-led conversion

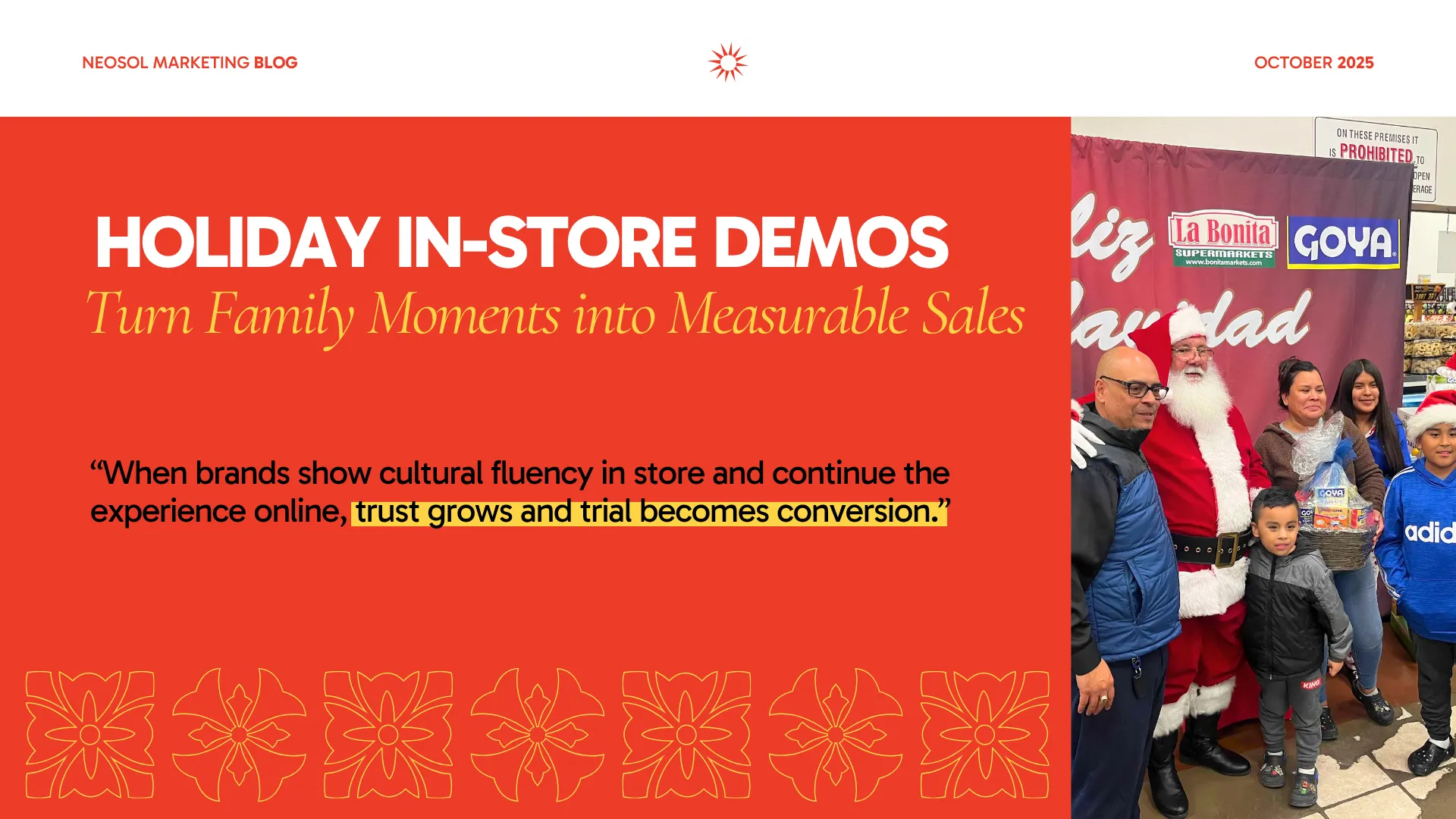

NielsenIQ’s Multicultural Momentum report shows around 30% of Hispanic dollars are now spent online, up from roughly 26% in earlier years, driven by Gen Z and Millennial shoppers. Yet Circana data confirms that Hispanic households still over index in grocery, mass and club, where food, beverage and household CPG dominate the basket and are growing faster than among non Hispanics.

The pattern is clear: Hispanic shoppers discover on mobile and social, then decide at the shelf. Your 2026 plans should connect retail media, social content and search with in-store execution: endcaps, secondary placements, field marketing and demos that close the loop from click to cart.

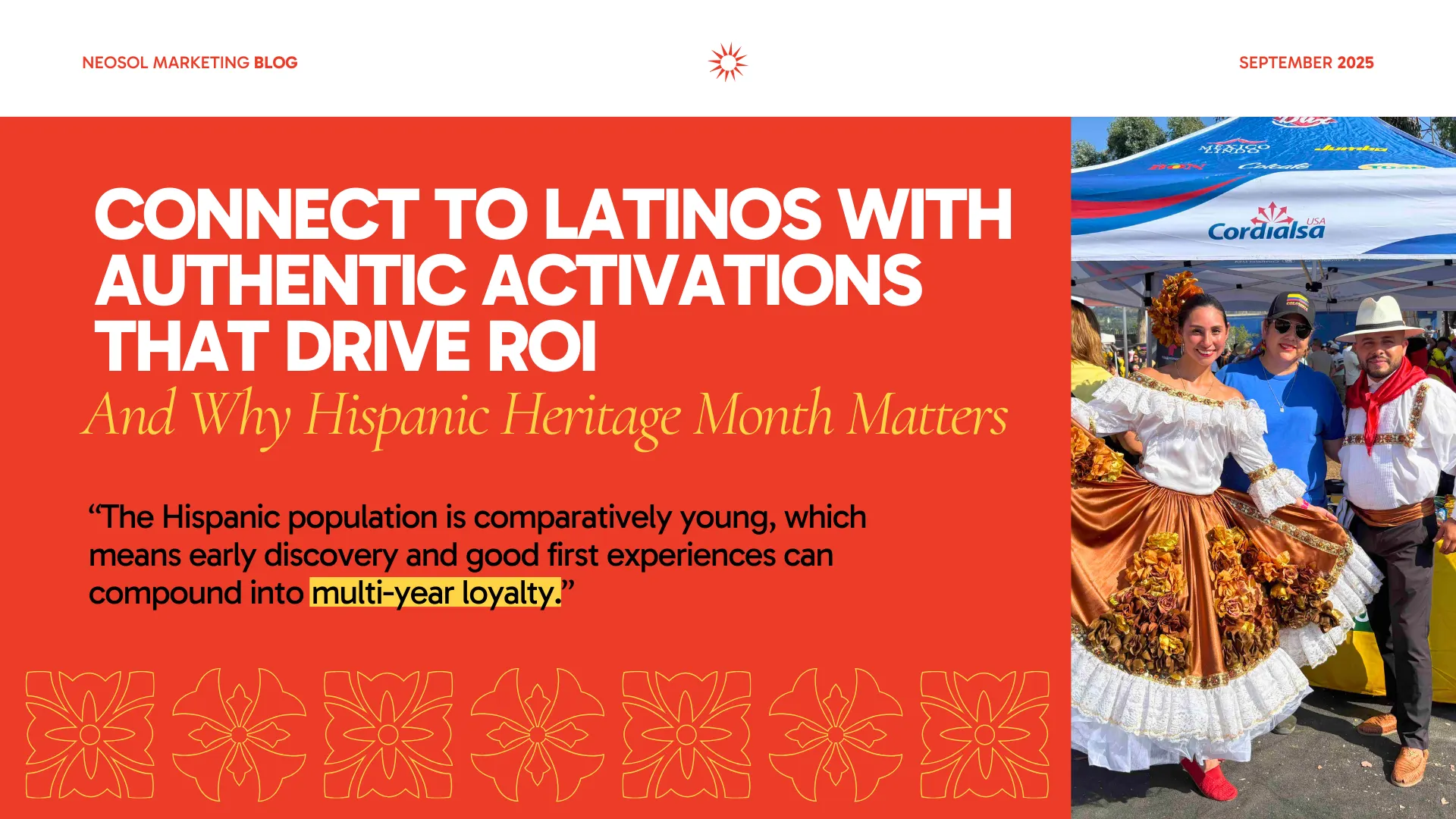

3. Trust, culture and representation as growth drivers

Collage Group reports 79% of Hispanic consumers say trusting a brand is key to their purchase decisions, and that trust comes from safety, values and cultural alignment, not slogans. Claritas’ 2025 Hispanic Market Report adds that the Hispanic population is approaching 70 million by 2026, projected to represent over 20% of the U.S. population and around 80% of population growth through 2031.

For CPG brands, that means multicultural marketing is not a side project. It is core to brand building and shopper strategy. Invest in bilingual storytelling, authentic representation in creative and in-store staffing, and programs rooted in real community rituals and usage occasions. Hispanic shoppers will reward brands that feel aligned with their identity and everyday reality, and quietly move away from those that do not.

The bottom line for 2026

The Hispanic shopper you are planning for is:

- Under economic pressure, but still committed to showing up for family and community.

- Mobile-first in discovery, omnichannel in behavior, and very active in brick-and-mortar.

- Highly sensitive to trust, culture and representation when choosing CPG brands.

If your 2026 plan connects value, omnichannel paths and cultural relevance with strong in-store execution, Hispanic shoppers will not just be an audience in your deck. They will be the source of your next wave of retail growth.

For more knowledge and insights subscribe to our newsletter HERE.